I’m as excited as everyone else about Facebook’s IPO – hopefully it will mark the passing of an era, and people can move on to talk about something else.

For me it started back in 2006 when I went to work for my first social media startup, a company that very quickly seemed to lose it’s way and just wanted to try to capitalize on Facebook some how. Myself I did not(and still don’t) care about social media, one of the nice things about being on the operations/IT/internet side of the company is it doesn’t really matter what the company’s vision is or what they do, my job stays pretty much the same. Optimize things, monitor things, make things faster etc. All of those sorts of tasks improve the user experience no matter what and I don’t need to get involved in the innards of company strategy or whatever. I mistakenly joined another social media startup a few years later and that place was just a disaster any way you slice it. No more social media companies for me! Tired of the “I wanna be facebook too!” crowd.

Anyways, back on topic. The forthcoming Facebook IPO. The most anticipated IPO in the past decade I believe anyways. Obviously tons of hype around it but I learned a couple interesting things, yesterday I think, that made me chuckle. This information comes from analysts on CNBC – I don’t care enough about Facebook to research the IPO myself it’s a waste of time.

Facebook has a big problem, and the problem is mobile. There hasn’t been any companies that have been able to monetize mobile(weird thinking I worked at a mobile payments company going back to 2003 that was later acquired by AMDOCS which is a huge billing provider for the carriers) in the same way that companies have been able to monetize the traditional PC-based web browsing platform with advertising. There have been companies like Apple that makes tons of money off their mobile stuff but that’s a different and somewhat unique model. The point is advertising. Whether it’s Google, or Pandora, Facebook, and I’m confident Twitter is in the same boat. Nobody is making profits on mobile advertising – despite all the hype and efforts. I guess the screen is too small.

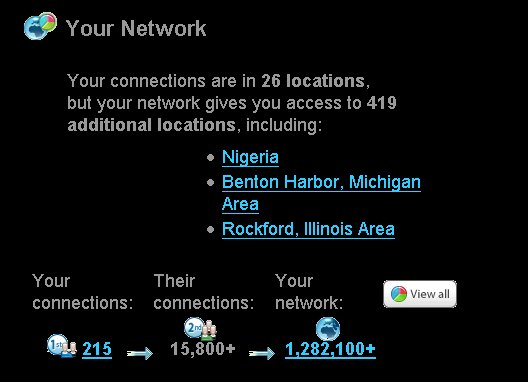

So expanding on that a bit, this analyst said yesterday that outside of the U.S. and parts of Europe the bulk of the populations using Facebook use it almost exclusively on mobile – so there’s no real revenue for Facebook from them at this time.

Add to that apparently Facebook has written China off as a growth market for some specific reason(don’t recall what). Which seems contrary to the recent trend where companies are falling head over heels to try to get into China, giving up their intellectual property to the Chinese government(why..why?!) to get into that market.

So that leaves the U.S. and a few other developed markets that are still, for the most part, using their computers to interact with Facebook.

So Facebook is in a race – to be the first company to monetize mobile before their lucrative subscriber base that they have in these few developed markets shifts away from the easy-to-advertise-on computer platform.

Not only that but there’s another challenge that faces them as well. Employee retention. Myself of course would never work for Facebook, I’ve talked to several people that have interviewed there, and a couple that have worked there and I’ve never really heard anything positive come out of anyone about the company.

Basically it seems like the only thing holding it together is the impending IPO. In fact at one point I believe it was reported that Zuckerberg delayed the IPO in order to get employees to re-focus on the company and software and not get side tracked by the IPO.

So why IPO now? One big reason seems to be taxes, of all things. With many tax rates currently scheduled to go up on Jan 1, 2012 – Facebook wants to IPO now, with the employee lock up preventing anyone from selling shares for six months – that gets you pretty close to the New Year, and the potential new taxes.

The IPO is also expected to trigger a housing boom in and around Palo Alto, CA. I remember seeing a report about a year ago that mentioned many people in the area wanted to sell their houses but were holding off for the IPO – as a result the housing market(at least at the time, not sure what the state is now) was very tight with only a few dozen properties on the market out of tens of thousands.

There was even a California politician or two earlier in the year that said the state’s finances weren’t in as bad of shape as some people were making out because they weren’t taking into account the effect of the Facebook IPO. Of course recently it was announced that things were in fact, much worse than some had previously communicated.

I’m not saying the hype won’t drive the stock really high on opening day – wouldn’t surprise me if it went to $90 or $100 or more. It seems like the IPO road show that Facebook took, in their case it felt like a formality more than anything else. I just saw someone mention that in Asia the IPO is 25X oversubscribed.

One stock person I saw recently mentioned her company has received more requests about the Facebook IPO than any other IPO in the past 20 years.

Maybe they can pull mobile off before it’s too late, I’m not holding my breath though.

I really didn’t participate in the original dot com bubble, I worked at a dot com for about 3 months in the summer of 2000 but that was about it. So this comparison may not be accurate but the hype around this IPO really reminds me of that time, I’m not sure how many of the original dot com companies you would have to combine to reach a market cap of $100B, hopefully it’s 100 at least. But it’s sort of like a mini dot com bubble all contained within one company. With so many other wanna be hopefuls in the wings not able to get any momentum to capitalize on it beyond their initial VC investments. The two social media companies I worked for combined got around I want to say $90M in funding alone.

Another point along these lines, is the esteemed CEO of Facebook seems to be on a social mission and cares more about the mission than the money. That reminds me so much of the dot com days, it’s just another way of saying we want even more traffic, more web site hits! Sure it’s easy to not care much about the money now because people have bought the hype hook line and sinker and are just throwing money at it. Obviously it won’t last though 🙂

Myself of course, will not buy any Facebook stock – or any other stock. I’m not an investor, or trader or whatever.