I’ve been seeing an increasing number of people (some of whom I at least know of and respect) saying how bad the LinkedIn IPO was yesterday.

A recent one I just came across is from John Dvorak (damn I miss Cranky Geeks), who has a column on the Wall Street Journal site saying how the LinkedIn IPO could ruin the tech sector.

Myself I don’t agree that the IPO itself could ruin the tech sector, I think it’s just another part of the frenzy in social media, LinkedIn is of course seen as a gateway into one of the leaders in the space and there has been so much hype being built up over the years. It’s just a sign as to how rabid some of these people are(the fact that there is a whole second market for this kind of stuff that has opened up is far more concerning to me than the IPO). Whether or not they IPO’d wouldn’t of changed that fact.

I just think back to my days at Jobster(closed up shop about two years ago) when they were running rampant on the social media stuff, I couldn’t believe my eyes or ears. I knew the days were numbered when the management of the company wouldn’t let us remove bad email addresses from our databases (the bad email addresses were causing us to get blacklisted, hampering abilities to do the amount of email traffic to users that we were doing).

We couldn’t delete them because it would hurt our user count. I mean oh my god, are you kidding me? These users are not there anymore! Maybe they never were there! They are actually impacting other users by having their emails bounce! I suppose another approach we could of taken was somehow flag the accounts to not email them, but nobody seemed to come up with that idea at the time.

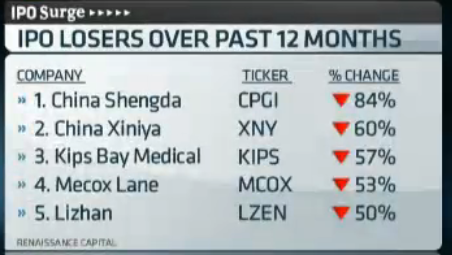

Here is a good video on some of the hot IPOs in the past year (many from China), and how poorly they have done since they debuted. I tell ya, the more I read and learn about stocks and investing the less interested I become in ever participating in it.

Maybe I’ll get lucky and the world will end tomorrow and I won’t have to worry about my home grown retirement plan 🙂

China is not fore investing. Look what Alibaba did with its Alipay service, as well as the numerous frauds that have been brought to market with major backing from Goldman and others (Longtop Financial for instance). Your money is at risk in that country.

Comment by tgs — May 21, 2011 @ 12:11 pm